The Future of XRP and RLUSD: A Promising Horizon for Crypto Investors

March 9, 2025 by Debra Teal

History is being made with the Digital Asset Reserve, and the US Digital Asset Stockpile made by President Trump.

Finally, a new horizon has come upon the world that will revolutionize the financial landscape. This means the not just the US, but the world of cross-border payments and global finance. Governments, corporate, banking, every day merchant use, and peer to peer payments will all move to a seamless, secure tokenized system to provide transparency, efficiency and cost effectiveness.

This could create a new generation of crypto millionaires. The crypto community is a buzz with bold predictions for XRP’s future value. Some analysts are forecasting an astronomical rise, with price targets ranging from $10,000 to as high as $35,000 per token. While these figures may seem ambitious, several factors could drive XRP to these unprecedented heights.

XRP and RLUSD Explained in Simplicity

XRP is a very unique cryptocurrency that provides a use. The Ripple USD aka RLUSD is a stablecoin that’s pegged to the US Dollar at 1:1, meaning RLUSD is a tokenized system, built on top of the XRP Ledger, (XRPL).

The RLUSD stablecoine is the only digital dollar backed by the US Treasury, making XRP and Ripple one of a kind. Additionally, Ripple and XRP are one of the only few cryptocurrencies that are IS0 20022 compliant.

Currently, we have a system that takes days for a payment settlement. This lag and gap in time is very costly, and inefficient. This new system provides transparent, instantaneous and reliable use of well-regulated stablecoins for payments. The ownership of this tokenized money would be on a shared Ledger (XRPL), which is then accessible to all the participants. This will also allow peer-to-peer transfer in one simple step at a tiny fraction in comparison to today’s costs, and far less prone to error.

There is a good reason to engage modernizing our payment structure right now, because other countries around the world also are embracing new payment technologies. Plans are underway for 80% of Japanese banks to integrate XRP by 2025, aiming to modernize cross-border payments, and just lowered their taxes on crypto. Additionally, XPR is in over 190 countries, and has partnered with over 50 Markets globally, according to thecryptobasic.com.

XRP: Revolutionizing Retail Payments

Let’s take a look at XRP case use, which extends beyond cross-border transactions to revolutionize retail payments:

1. Speed and Scalability

- Transaction Speed: XRP offers unparalleled speed and efficiency, processing payments in seconds at a fraction of the cost of traditional systems. Costs are as low as $0.0002 per transaction, making it cost-effective for microtransactions and cross-border payments.

- Scalability: The XRP Ledger (XRPL) can handle up to 1,500 transactions per second (TPS) under normal conditions, with potential for higher throughput through sidechains or network optimizations.

- Low Latency: Transactions are confirmed almost instantly, ensuring real-time settlement even during high network activity.

- Minimal Fees: XRP transaction costs are as low as $0.0002 per transaction, making it cost-effective for microtransactions and cross-border payments.

- Energy Efficiency: Unlike Bitcoin or Ethereum, XRP does not rely on energy-intensive mining, making it more sustainable and eco-friendly.

- XRP serves as a bridge currency, enabling seamless conversion between different fiat currencies. This reduces the need for pre-funded nostro/vostro accounts and improves liquidity for financial institutions.

- Cross-Currency Payments: The XRP Ledger facilitates real-time cross-currency payments with atomic precision, eliminating intermediaries and reducing errors.

- RippleNet’s On-Demand Liquidity (ODL) uses XRP to facilitate instant cross-border payments without requiring pre-funded accounts.

- Innovative Features: XRPL supports a range of functionalities relevant to retailers, including checks, escrow, partial payments, and payment channels, enhancing flexibility and security in retail transactions.

- Multi-Currency Exchange XRPL includes a built-in decentralized exchange (DEX), allowing users to trade multiple currencies directly on the ledger. It supports atomic settlement of multi-currency payments across borders, enhancing its utility in global trade scenarios.

- Cross-Border Payment Revolution: XRP’s primary goal of addressing inefficiencies in global payments, particularly in cross-border transactions, positions it uniquely in the market. If XRP becomes the standard in financial systems, demand could surge exponentially.

- Tokenization of Real-World Assets: The growing interest in tokenizing real-world assets RWAs on the XRP Ledger (XRPL) could also significantly increase XRP’s utility and value. There has been a growing interest for the corporate sector to tokenize everything and put it on the ledger for a swift, seamless, secure, and transparent process of transacting in today’s world of technology.

President Trump’s Recent Moves

President Donald Trump recently announced of XRP’s inclusion in the proposed crypto strategic reserve gave a significant boost in confidence to investors. His announcement not only legitimizes XRP but also suggests potential for massive institutional adoption. However, while Trump initially mentioned including XRP, Cardano, and Solana alongside Bitcoin in the proposed crypto reserve.

A senior White House official clarified stated that the cryptocurrencies mentioned by Trump were just examples, not necessarily the final selection for the reserve. The executive order specifically establishes a Strategic Bitcoin Reserve, with other cryptocurrencies relegated to a asset separate stockpile.

Bitcoin doesn’t have a utility. Rather, Bitcoin was originally created to move away from the unbacked US fiat dollar, corrupt institutions and banks. XRP and RLUSD clearly provide a huge use case utility with scalability worldwide. In my opinion, XRP, Bitcoin and even a new dollar will come out and be backed by precious metals or natural resources. There is great speculation that gold is also overdue to be revalued, and once done will go back to backing the US Dollar.

“Understand the utility. If there’s real utility and there’s real value being delivered to a real customer, there will be value in the token.” – Brad Garlinghouse, Ripple CEO

The US Digital Asset Stockpile

- Separate from Bitcoin Reserve: XRP is not included in the Strategic Bitcoin Reserve, which is exclusively for Bitcoin. Instead, XRP falls under the U.S. Digital Asset Stockpile.

- Management of Seized Assets: The Digital Asset Stockpile will contain cryptocurrencies other than Bitcoin that have been seized and confiscated through criminal or civil proceedings. This includes XRP, and altcoins like Ethereum, Solana, and Cardano. No other altcoins have been discussed.

- Treasury Department Oversight: The Digital Asset Stockpile will be managed by the Treasury Department, focusing on responsible stewardship of the government’s digital assets.

- No New Acquisitions: The government does not plan to purchase additional XRP or other cryptocurrencies for the stockpile. It will only contain assets already in government possession through forfeitures and penalties.

- With XRP now authorized for custody by the US Treasury, Ripple can now donate, transfer or lend XRP from its massive escrow reserve to our Us treasury.

- Potential Future Use: While there are no immediate plans for active management or utilization of XRP in the stockpile, its inclusion suggests the government recognizes its potential value and may develop strategies for its use in the future.

- Regulatory Implications: The stockpile’s creation may influence future regulatory decisions regarding XRP and other altcoins, potentially affecting their status and adoption in the U.S. financial system.

While XRP is not part of the Strategic Bitcoin Reserve, its inclusion in the Digital Asset Stockpile with US Treasury Department oversight is a huge statement. As far as Bitcoin, it will serve as a long-term store of value rather than liquidation.

This aligns with Trump’s vision of the US being the crypto capital of the world, and the US now having a “digital Fort Knox.” In contrast, the altcoins within the Digital Assets Stockpile will come from seizures of criminal activity and may be liquidated at the discretion of the Treasury Secretary.

Earlier on Friday March 7th, David Sacks, White House Crypto Czar, stated that Bitcoin “deserves special treatment” over altcoins like Ethereum, Solana, XRP, and Cardano—because it is more secure, more decentralized, and doesn’t have an issuer. “You can think of [Bitcoin’s] $2 trillion market cap like a bug bounty—trying to find holes in the [network’s] security,” Sacks said Friday. “And no one’s ever been able to do it…. So we believe that it is special.”

This revolution could create a new generation of crypto millionaires.

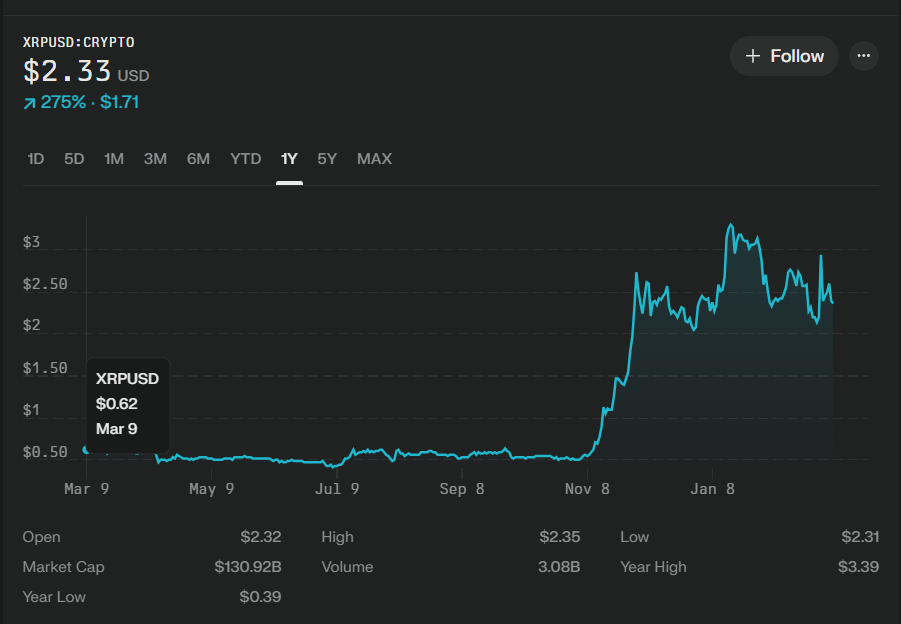

XRP 1 Year Chart

The Road to Millionaire Status for XRP Holders

The potential for XRP to reach five-digit values has sparked excitement among investors. Crypto analyst Egrag suggests that in the future, a holding of 20,000 XRP could be worth an astounding $190 million. While this prediction may seem optimistic, it reflects the growing confidence in XRP’s long-term potential.

Conclusion

As XRP continues to gain traction in the world of global finance, its unique position as a utility token with controlled supply through escrow may redefine how we think about cryptocurrency value. While the idea of gold-backing remains speculative, XRP’s growing adoption for cross-border payments suggests that its true value may lie in its utility rather than traditional market cap metrics.

The coming years will be crucial in determining whether XRP can fulfill its potential as a global financial utility, potentially reshaping the landscape of international money transfers and challenging conventional notions of cryptocurrency valuation.

Your donations are greatly and lovingly appreciated by the author.

Make a one-time donation

Choose an amount

Or enter a custom amount

Your contribution is appreciated.

DonateThis article is for entertainment purposes only. Always seek the advice of a financial advisor. Crypto markets can be volitile. Because crypto is now being held by the US Governement, crypto is likely going to be a currency of the future. If you want to invest in crypto and aren’t a professional day trader, it may be better to think long term, and hold your investment. Never invest more than you have to lose. This article and any information herein is strictly the opionion of the author. Do your own research. Verify information to your satisfaction. By using this site, you agree to hold harmless the author, associates, and site server, free of any and all claims.